Table of Contents

There’s no shortage of skilled lawyers out there. You know it. And your clients know it.

It's the "little" things that influence who they hire. That's why clients expect flexible payment options, automation, and 100% transparency.

In fact, nearly 60% of clients cite cost as their biggest hesitation when hiring a lawyer. They'd skip to your competitor in a heartbeat if they got a better payment plan.

Translation? Adapt today. Profit tomorrow.

In this guide, you'll learn how to win the modern billing war: offer flexible, compliant payment plans and build cash flow systems primed to scale. Let's dive right in.

What Is a Lawyer Payment Plan?

In plain English, a lawyer payment plan lets clients pay their attorney fees in smaller, scheduled amounts instead of one large lump sum upfront.

Simple idea, but incredibly smart! Here’s why firms and clients love it:

- It’s affordable: Clients can hire you without draining their savings.

- It’s consistent: You get a predictable monthly cash flow (no more feast or famine).

- It’s stress-free: No chasing invoices or awkward “friendly reminder” emails.

And this isn’t some fringe trend. According to the 2024 Legal Industry Report, 56% of law firms now offer payment plans, and 48% of those firms collect more money overall.

Think about it: When you offer payment plans, you bridge the client gap between “I need a lawyer” and “I can actually afford one.”

Next up — let’s break down how these plans work and why they’re quietly changing the game for modern law firms.

How Do Attorney Payment Plans Work?

A payment plan breaks a big legal bill into smaller, manageable chunks that both you and your client can count on. It gets rid of the sticker shock.

In fact, many law firms that offer more payment options have increased revenue by ~29%!

— The 4 Major Payment Plan Models

- Fixed Installment Plans: Clients pay a set amount each month — simple, predictable, and easy to automate.

- Milestone-Based Payments: Clients pay as you hit key checkpoints (e.g., filing, hearing, settlement). Common in litigation or immigration work.

- Evergreen Retainers: A running balance that automatically replenishes once it dips below a set amount. Great for ongoing matters like business law or family law.

- Hybrid Models: A mix of the above — for instance, a smaller upfront retainer followed by monthly payments.

— The Client Journey: From Lead to Payment

Here’s what your typical client journey looks like: Lead → Screening/Underwriting → Agreement → Autopay Setup.

It all starts online. Your website is the #1 lead source, powered by SEO and PPC campaigns that attract potential clients looking for help.

Once they’re in the pipeline, you screen them to ensure they can handle a payment plan. After both sides agree, autopay keeps everything smooth and on schedule.

And yes! Payment plans can be tailored to any practice area or legal representation:

- Family & Divorce Lawyers: Hybrid models work best here — a smaller upfront retainer followed by monthly payments helps clients manage costs during stressful transitions.

- Immigration Lawyers: Milestone-based payments make sense here — pay as each step in the process is completed.

- Criminal Defense Attorneys: Fixed installments help clients manage urgent cases without waiting to gather the full payment.

At the end of the day, the process isn’t just about collecting money... it’s about removing friction and keeping your cash flow steady.

7 Huge Benefits for Law Firms and Clients

Flexible payment plans aren’t just good optics. They’re good business!

You could turn a hesitant client into a committed one and make it easier for both sides to breathe (and budget). Here’s what’s in it for everyone:

For Law Firms:

- Higher Conversions: Clients are far more likely to say “yes” when you make paying easier.

- Predictable Revenue: No more waiting on random checks — recurring payments mean steady cash flow.

- Lower Accounts Receivable: Automated billing reduces late or missed payments.

- Competitive Edge: When prospects are comparing firms, flexibility can be the deciding factor.

For Clients:

- Affordability: Smaller, scheduled payments make legal help realistic.

- Transparency: Clear terms upfront mean no surprise invoices later.

- Access to Counsel: More people can hire representation when price isn’t an immediate barrier.

What better way to keep your firm’s revenue consistent and avoid losing leads to a competitor? This is a win-win on every front!

4 Reasons Lawyers Should Consider Offering Payment Plans

You’ve seen what payment plans are. You've seen how they work. Now, let’s talk about why they’re worth it — for your clients, your cash flow, and your peace of mind.

— Reduce Time Spent on Payment Follow-Ups

Chasing down late checks is a pain in the butt.

When your firm offers structured payment plans, clients’ payments roll in automatically, cutting the time you spend on “friendly” reminders.

Businesses that offer flexible payment options do it for good reason: 48% say it reduces costs, and 39% say it gives them (and their clients) more peace of mind.

Want even more efficiency? Go digital. A solid legal billing software handles autopay, failed charge alerts, and balance tracking for you.

— Increase Collection Rate

When clients can pay how they want, they actually do.

In a study of firms using faster payment options, 88% reported business growth after adoption.

That's huge! It's a testament to how flexible payment plans remove friction and make it easier for clients to keep up.

TLDR: Set clear terms, automate billing, and your collection rate will climb while your follow-up list shrinks.

— Make Your Legal Services More Accessible

For most clients, the issue isn’t price — it’s cash flow. Big upfront lawyer fees scare people off!

Flexible payment plans fix that. Across industries, companies that offer installments see up to 40% more sales because people can actually say yes.

Break it down, make it doable, and suddenly your services are within reach.

— Improve Client Satisfaction

Happy clients stick around, and pay on time. That's the beauty of payment plans! They make the whole experience less stressful and more predictable.

It's no wonder that 83% of U.S. businesses and 75% of consumers already use faster payment plans and options.

When paying feels easy, clients remember the service — not the bill!

How to Implement Payment Plans in Your Firm

Alright, time to make it happen. Setting up payment plans isn’t rocket science, but it does take a plan. Map out your model, choose the right tools, and keep things running smoothly from day one. Here’s how:

Step 1: Designing Your Payment Plan Model

Before you roll out payment plans, pause. Do you know what kind of plan actually fits your firm? Ask yourself the right questions up front:

- What services or case types will this apply to?

- How much should clients pay upfront, and what’s the ideal payment schedule?

- How long should the plan run — weeks, months, or until completion?

- What happens if a client misses a payment?

- How will you track payments and handle late or failed charges?

- Does your plan align with ethical rules in your state or practice area?

Be flexible. The first version of your plan might not be perfect, but it’ll get better with every client you serve.

Step 2: Provide Multiple Payment Options

The more ways clients can pay you, the faster they do. Focus on ironing out the client experience.

Here are the top payment types to consider for your firm:

- Debit and Credit Card Payments — convenient, secure, and ideal for autopay.

- ACH / Bank Transfers — low fees and great for recurring payments.

- E-Checks — digital checks that process faster and reduce paper clutter.

- Mobile Payments — Apple Pay, Google Pay, or similar apps for on-the-go clients.

- Installments or “Pay-Over-Time” Plans — perfect for high-value retainers or clients who need breathing room.

Meet clients where they are. The easier it is to pay you, the faster they’ll say “yes" to resolve their legal matter.

Step 3: Drafting the Payment Plan Agreement

Time to make it official! A strong payment plan agreement protects both you and your client, setting clear terms from day one.

Here’s what to include for your client base:

- Payment Details: Total amount, frequency, and due dates.

- Accepted Methods: List how clients can pay — card, ACH, etc.

- Late or Missed Payments: What happens if payments are delayed? Spell it out clearly.

- Communication Clause: Outline how reminders or notices will be sent.

- Compliance Check: Make sure your agreement follows state bar and trust accounting rules.

Pro tip: Keep it in plain English. Clients should understand exactly what they’re agreeing to.

Step 4: Using Legal Payment Software

You could manage payment plans manually... but it's 2025.

Legal payment software makes the entire system work for you. Here’s how the right software changes the game:

- Automates billing & reminders so you don’t waste brain cells sending emails.

- Accepts payments online (cards, ACH, etc.), updating your records instantly.

- Shows you an accounts dashboard that tracks outstanding balances, failed charges, and trends.

- Handles compliance checks automatically, reducing risks and errors.

In fact, legal billing tools enable 57% of electronic payments to be completed the same day a bill is sent, helping firms get paid faster.

Want to see your options? Check out the top payment systems for lawyers to find a tool that fits your flow.

Step 5: Systems for Monitoring and Missed Payments

Even the best clients forget things — that’s life.

What matters is how your firm handles it. A smart monitoring system keeps you one step ahead of missed payments. Here’s what to set up:

- Automatic reminders before and after due dates.

- Monthly reports showing who’s paid, who’s late, and which plans need adjusting.

- Follow-up protocols that balance professionalism with empathy.

Ask yourself:

- How often will you review payment data — weekly or monthly?

- Who’s responsible for monitoring and client outreach?

- What’s your policy if a payment fails more than once?

- Do you have a system for flagging and pausing services if accounts fall behind?

- How will you record and document all communication about missed payments?

When your systems run smoothly, late payments become rare, and a stress-free day becomes standard.

Payment Plans vs. Legal Fee Financing

Both payment plans and legal fee financing help clients afford your services — but they work very differently.

A payment plan keeps billing in-house, where you control the terms and collect payments directly from clients.

Legal fee financing brings in a third-party lender who does your payment upfront, then collects from the client over time.

Here’s how they stack up:

Each model has its perks — the right one depends on your cash flow needs, tolerance for risk, and how much control you want over client payments.

— In-House Payment Plans

With an in-house payment plan, you’re in charge. You set the terms, send the bills, and collect payments yourself. Clients pay you directly in easy installments.

Here’s why many firms love this approach:

- Full Control: You set the terms, adjust when needed, and keep the entire payment (no lender fees cutting into profits).

- Steady Cash Flow: Payments trickle in consistently, helping you cover monthly expenses and plan for growth.

- Stronger Client Relationships: You stay in direct contact with clients, building trust and loyalty over time.

- Flexibility: You can adapt plans based on case type, client situation, or seasonality — perfect for smaller or mid-size firms that want to stay nimble.

- Low Setup Costs: No middlemen, no financing contracts, just a clear agreement and a billing system that works.

Best For:

Family law, criminal defense lawyers, and small business attorneys — any practice where clients may need extra breathing room but prefer to deal directly with their lawyer.

— Third-Party Legal Fee Financing

With legal fee financing, a lender steps in to cover your fee upfront. The client then pays the lender back in installments, while you get paid immediately.

Here’s why it works for many firms:

- Instant Payouts: You receive your full fee upfront, improving cash flow and removing uncertainty.

- No Collection Hassles: The lender manages repayment, reminders, and any defaults — freeing your team from chasing invoices.

- Lower Risk: Since you’re paid in advance, you’re not affected if a client misses payments.

- Easier Client Approval: Many financing companies offer fast, low-barrier applications — clients can get approved within minutes.

- More Closed Deals: Clients who might hesitate at a large retainer can move forward when financing is available.

Best For:

Firms handling high-value or one-time cases — such as personal injury, business litigation, or medical malpractice — where upfront payments can be steep, but quick financing helps close the deal fast.

Should You Offer Payment Plans or Legal Fee Financing?

Ultimately, there's no one-size-fits-all answer. It really depends on your clients and your cash flow goals.

If you want full control and don’t mind slower payments, go with in-house payment plans. They’re great for practice areas like family law or criminal defense, where clients value flexibility and direct communication.

If you need cash upfront and prefer less risk, legal fee financing is your friend. It’s ideal for high-ticket or one-time cases like business litigation or personal injury, where getting paid immediately matters most.

In short: choose the model that keeps your clients comfortable and your revenue consistent.

Ready to Grow Your Revenue and Stress Less?

You’ve just seen how payment flexibility can win more clients. But if you really want to scale, you need a marketing system that brings in those clients every day.

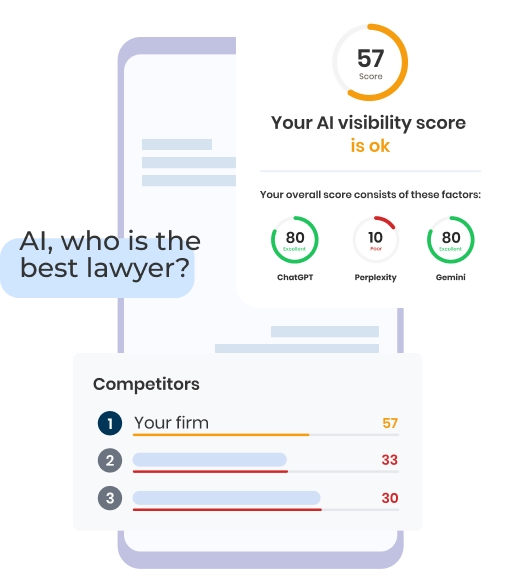

For over 18 years, Grow Law has helped 100+ law firms dominate their markets with a mix of AI-driven SEO, PPC, and high-converting website design.

Just like one of our clients, Omar Ochoa Law, you could witness insane results:

- 3,345% marketing ROI

- 1,000% increase in qualified leads

- 2,592% boost in organic traffic

all in just 18 months! Your firm could be next.