Table of Contents

Winning cases but losing financially?

We feel you. Too many attorneys and law firms get stuck with slow-paying clients, delayed settlements, and bills that cannot wait.

Law firm financing, to the rescue!

The right plan takes that “stop-and-go” cash flow into something steady — so you can focus on winning cases, instead of chasing payments.

In the next 10 minutes, you’ll see the best financing options for 2026, how to pick the right one for your firm, and which financing method truly comes out on top.

Key Takeaways:

- Cash flow wins cases — top firms use financing to stay steady and scale faster.

- You get the funds to market, hire, and grow without waiting for settlements to clear.

- Learn which financing options work best for your practice area and goals.

- Find out how the right setup can lower stress and boost client outcomes.

- Discover the #1 pick for your firm — and how it could change how you grow.

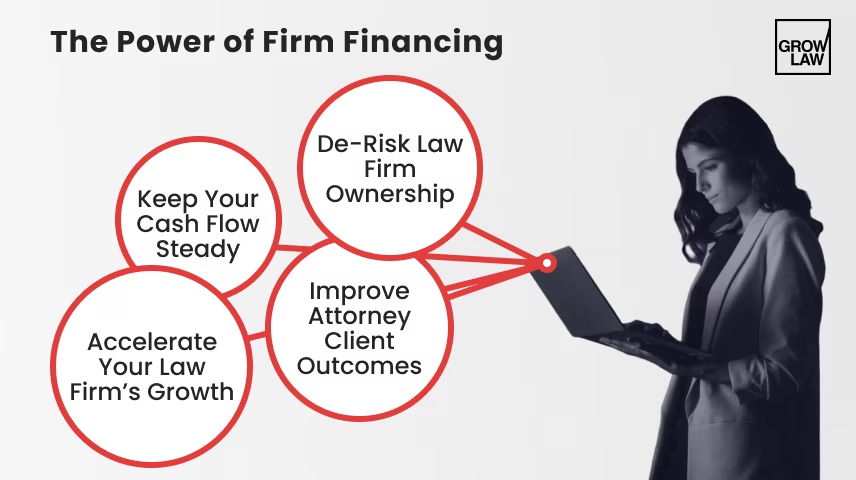

Why Law Firm Financing? Strategic Benefits Beyond Survival.

Your CPA has probably mentioned law firm financing three times by now. Why should you care about it? Because it goes beyond keeping the lights on.

It’s the quiet power behind faster growth, smoother cash flow, less stress, and happier clients. Take a look:

— Accelerate Your Law Firm’s Growth

You probably know this already, but growth takes resources — a LOT of them. Marketing, new hires, bigger cases… it all adds up fast.

That’s why you need financing. It gives you the freedom to move when you want to, not when the settlement clears.

You can invest in marketing, bring on great people, or fund cases that take time to pay out but bring big rewards later.

P.S. Financing helps your firm grow on purpose instead of waiting for luck or timing to line up.

— Keep Your Cash Flow Steady

You know that weird limbo between cases closing and checks clearing?

It's stressful!

Financing helps smooth that out. You’ll have money when you need it — steady, predictable, and easy to plan around.

That means you won't have to panic over payroll, ad budgets, or office and personal expenses when a case drags on.

— De-Risk Law Firm Ownership

Owning a firm is rewarding, but it’s also risky. There’s rent, staff, and overhead, not to mention the cases that take forever to close.

Financing helps you carry that load. Instead of draining your personal savings or juggling credit cards, you can tap into that funding.

It gives you a cushion for slow months and room to grow without the financial pressure.

— Improve Attorney Client Outcomes

When your finances are stable... everything else improves, including your client outcomes.

Financing lets you fund expert witnesses, hire top support staff, and dedicate more time to each case instead of worrying about money.

Clients can feel that difference! They’ll see a firm that’s confident, well-resourced, and fully focused on their case.

Law Firm Financing vs. Law Firm Loans

You hear "law firm financing" and probably think of a traditional bank loan, right? It makes sense. For years, that was the default way for firms to access capital.

But in 2026, you’ve got better and faster options. Here’s how they stack up:

1. Traditional Debt (Loans or Lines of Credit)

This is the classic approach: you borrow from a bank or lender, pay interest, and start repaying right away.

Pros:

- Predictable monthly payments make it easy to budget.

- Lower interest rates — if your credit and firm financials are strong.

- Full flexibility to use the funds however you want: payroll, marketing, case costs, etc.

Cons:

- Banks can be slow to approve and notoriously strict with law firms.

- Many won’t count pending contingency fees as collateral.

- You’re personally liable — repayments continue even if your cases drag out or fall through.

Best for: Established firms with steady revenue and good credit.

2. Non-Recourse Capital

This funding is backed by your future case proceeds, not your personal or business credit. The lender gets paid only when your cases settle.

Pros:

- No personal liability — the lender assumes the risk.

- No monthly repayments eating into your cash flow.

- Ideal for contingency firms handling long, high-value cases.

Cons:

- Higher overall cost since lenders take on greater risk.

- Not all cases qualify — lenders prefer strong, winnable portfolios.

- Limited flexibility — funds are usually tied to specific case expenses.

Best for: Plaintiff firms in PI, medical malpractice, or mass torts with long case cycles.

3. Revenue-Based Financing (RBF)

Think of RBF as “growth capital that moves with your income.” You receive upfront funding and repay a small percentage of your monthly revenue until the amount (plus a flat fee) is paid off. Payments rise and fall with your firm’s income.

Pros:

- No fixed payments — repayments adjust with your income.

- No equity loss or personal collateral required.

- Fast approval compared to banks.

Cons:

- Can cost more overall if your firm’s revenue grows quickly.

- Harder to qualify for if revenue is inconsistent.

- Not every lender offers this yet, especially for law firms.

Best for: Growing firms with stable monthly revenue that want flexibility without personal risk.

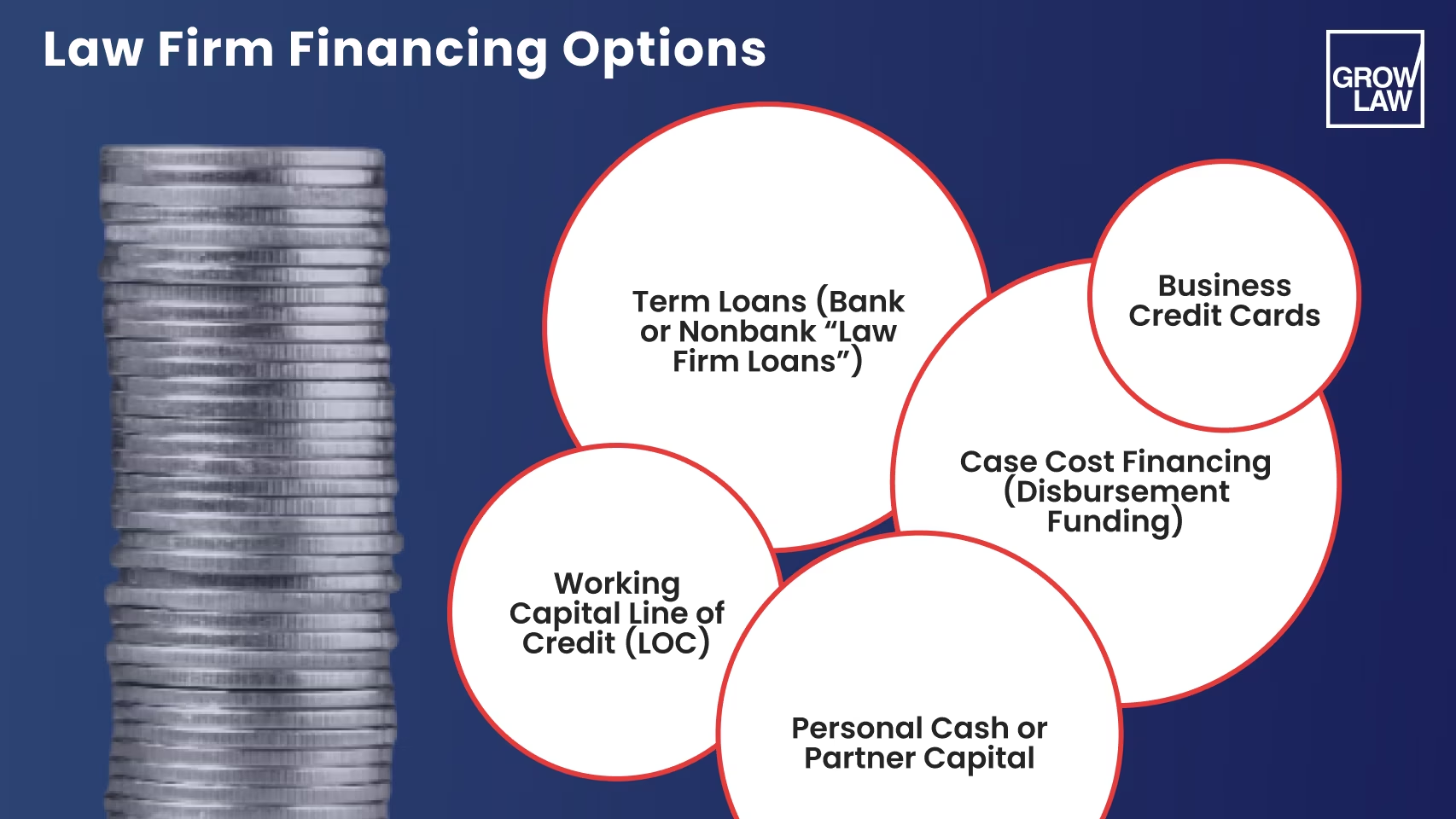

Law Firm Financing Options

Okay, now let's look at your options. If you’re exploring financing for attorneys — good news — you’ve got more choices today than ever before!

Each of these 5 financing structures fits a different stage of growth and risk tolerance.

— Personal Cash or Partner Capital

Let’s start with the obvious one — your personal money.

Have you already dipped into your savings or pooled cash with a partner to cover expenses? It’s quick and easy, sure, but it’s also risky.

You’re tying your personal life to your business, and if a big case runs long, that line blurs fast. In the long term, it’s better to keep your personal finances separate from your firm's growth.

TLDR: External law firm funding is recommended for most legal practices.

— Business Credit Cards

Credit cards are great for smaller, day-to-day expenses like travel, software, or supplies.

They’re flexible and easy to get, which makes them tempting.

But here’s the catch: interest stacks up fast, and if you’re carrying a balance every month, that “easy” funding turns expensive quickly. If you can pay them off each cycle, they’re useful. If not, they’ll quietly eat your profit.

— Working Capital Line of Credit (LOC)

Ever had a month where one case closes, another stalls, and you’re waiting on a settlement check that’s “definitely coming soon”?

That’s where a line of credit saves you! It gives you access to funds on demand.

You only pay interest on what you use, and it keeps things stable when revenue dips.

However, banks move slowly, and some don’t understand contingency work. Still, this one’s a favorite among firms that want predictable breathing room.

— Term Loans (Bank or Nonbank “Law Firm Loans”)

Thinking about expanding, hiring, or finally putting real money into marketing?

Fantastic! That’s when a term loan makes sense. You get a lump sum upfront and repay it in fixed monthly chunks.

It’s easy to plan for — but it takes time to secure. Traditional banks might ask for months of statements and won’t count pending cases as collateral.

Nonbank lenders move faster, but usually cost more. If you’re planning a big growth move, this option is worth exploring.

— Case Cost Financing (Disbursement Funding)

Work on contingency? Case cost financing helps cover all those expenses that pile up before a payout — expert witnesses, court fees, medical reports, and so on.

This is usually offered by specialized legal finance companies that are comfortable fronting money that’s tied to future settlements.

The beauty is, it frees up your own firm’s cash for other things. You can take on more cases without tying up capital in each one.

The downside? It’s pricier than a line of credit... not ideal for small business owners. But for many PI and mass tort firms, it’s the reason they can scale without stress.

What Types of Loans Are Best for Law Firms?

Here’s the short answer: The best financing depends on how your firm earns. The legal industry is too colorful for a one-size-fits-all recommendation.

Each practice area has its own rhythm, and your loan strategy should match it.

- Plaintiff firms (PI, med mal, mass torts): These practices deal with long case cycles and delayed settlements, so case-cost or portfolio funding keeps litigation moving while a small line of credit covers daily operations. A marketing term loan helps keep prospective clients coming in while you wait on payouts.

- Defense and commercial litigation firms: Cash flow often depends on slow client billing. A line of credit or invoice financing bridges that gap, while an occasional term loan works well for expansion or new hires.

- Corporate and transactional practices: These firms usually have steady income but need capital for big moves — like acquisitions, new tech, or office upgrades. A line of credit plus an SBA or term loan is the most balanced setup here.

- Smaller consumer-facing firms (immigration, family, criminal, estate planning): These practices benefit from flexibility. A modest line of credit smooths short-term dips, while a small-scale SBA or term loan funds marketing or staffing when growth picks up.

Match your funding to your cash-flow pattern, not your firm size. The closer it fits how and when you get paid, the smoother everything runs.

Creating a Long-Term Strategy for Your Firm

Before you jump into ANY financing decision, take a step back and look at the big picture.

Start by getting clear on a few personal and financial basics:

- What’s the minimum income you need to cover everyday living costs?

- How much helps you maintain your current lifestyle comfortably?

- What number would actually change your lifestyle for the better?

- What’s the most optimistic (but realistic) profit you can expect?

- What savings, assets, or credit could support you through slower months?

- And finally, what financial milestones do you want your firm to hit in years one through five?

Answering these questions gives you a true snapshot of your goals and risk tolerance before borrowing a dime.

When you’re ready to choose financing, think about it in two ways: how you bill and what you’re trying to achieve.

- By model:

- Contingency firms often rely on non-recourse or case-cost funding to cover long case cycles.

- Hourly firms benefit from lines of credit or term loans that keep operations smooth between billing and collection.

- Subscription or flat-fee firms may prefer revenue-based financing since payments adjust as revenue grows.

- By objective:

- To stabilize cash flow, go for a working capital line of credit.

- To fund growth, consider a term loan or revenue-based financing.

- To acquire another firm or expand into new markets, SBA or long-term loans work best.

- To buy real estate, traditional bank loans or secured credit lines are the most cost-effective.

Every firm’s path looks a little different, so begin with clarity. When you know what you’re aiming for, the right financing has a way of falling into place.

Final Verdict: Is Law Firm Financing Worth It?

Absolutely — if you use it strategically.

Remember, you're not just borrowing money. You're buying time, stability, and growth.

And as you’ve seen, different firms need different setups: case-cost funding for contingency practices, lines of credit for hourly firms, and term loans or RBF for growth-driven practices.

If you’re ready to make your firm’s growth predictable, contact Grow Law.

We’ve helped 100+ law firms nationwide achieve up to 380% ROI through data-driven marketing, AI optimization, and smarter revenue planning.

.svg)

.svg)